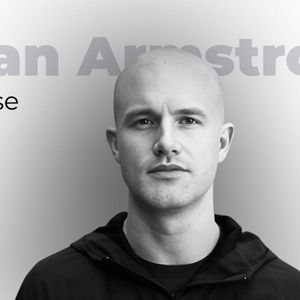

The Hyper Foundation has invested 1 million of its HYPE tokens into the creation of the Hyperliquid Policy Center. The center will focus on making sure that issues in the decentralized finance sector do not go unaddressed in the current crypto policy environment. The Hyperliquid policy center will be an independent nonprofi t fo cused on advocating for updated decentralized finance policies that match current realities. The Hyper Foundation commits almost $30 million t o De Fi policy push The Hyper Foundation has announced that i t has co mmitted 1 million HYPE tokens to fund the creation of the Hyperliquid Policy Center (HPC). Based o n the cu rrent market price, this grant is worth nearly $30 million. The tokens are set to be unstaked later today. The Hyperliquid Policy Center is an independent research and advocacy nonprofit that ensures that decentralized finance, or DeFi, has a clear and legal path to grow in the USA. Jake Chervinsky will come on board as the founding CEO of the organization. Chervinsky is a well-known figure in the crypto legal world who previously served as the Chief Legal Officer at the venture firm Variant and held a senior leadership role at the Blockchain Association. Last month, Hyperliquid processed over $256 billion in perpetual futures volume, but despite its massive growth, many of the products offered by the company, such as perpetual derivatives, currently operate offshore because U.S. financial laws were written for traditional, centralized systems. Hyperliquid processed $256 billion over the last 30 days. Source: Defillama Hyperliquid believes its community needs direct representation in Washington to protect its interests and explain how decentralized markets actually work. HYPE is currently trading at approximately $29.16, down significantly from its peak of $59.39 in late 2025. In collaboration with Policy Counsel Brad Bourque, formerly of the law firm Sullivan & Cromwell LLP, and Policy Director Salah Ghazzal, who was previously the policy lead at Variant, the company hopes to provide expert support and technical research that will lead to the creation and implementation of modern rules. The center is also actively hiring for several high-level roles, including a Chief of Staff, a Head of Communications, and a Head of Government Relations. How can the HPC impact DeFi regulation? To better establish a legal framework for on-chain perpetual contracts and properly close the gap between how these products are used globally and how they are viewed by U.S. regulators like the SEC and CFTC, the center will publish research that explains why decentralized protocols are different from traditional exchanges and how they can be regulated without destroying their unique benefits. In 2025, crypto policy progressed significantly with the GENIUS Act , which focused on stablecoin regulation, becoming law in July. The CLARITY Act has stalled in Congress after months of significant progress. The HPC aims to build on this momentum to ensure that DeFi-specific issues are addressed. Other groups, like the Blockchain Association, are making efforts to work with the current administration and Congress. Former CFTC Commissioner Summer Mersinger took over as The Blockchain Association’s CEO. The company held a major policy summit in December 2025, which saw record attendance from both industry leaders and bipartisan members of Congress. They have been focused on challenging restrictive IRS reporting rules and pushing for a comprehensive market structure bill. The smartest crypto minds already read our newsletter. Want in? Join them .