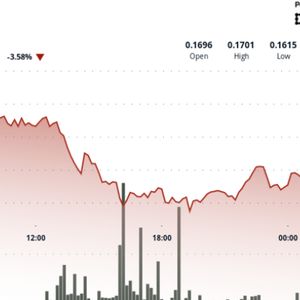

Dogecoin stabilized Saturday after a steep intraday decline, bouncing off a low of 16.1 cents and closing near 16.3 cents. The 5% drop came amid broader market volatility driven by macroeconomic concerns and shifting investor sentiment. Despite the downturn, DOGE showed signs of strength, with volume at support levels well above average, suggesting possible accumulation as the market seeks direction. News Background Global markets continue to absorb a wave of economic pressure from ongoing trade disputes and policy uncertainty. President Trump’s renewed tariff threats and unresolved fiscal debates are keeping risk assets — including cryptocurrencies — on edge. While memecoins like DOGE tend to amplify these swings, Thursday’s price action also showed signs of resilience. Dogecoin held firm above $0.162 with buyers stepping in at elevated volume, a sign that some participants may view current levels as a reasonable entry point. Technical analysts are watching for confirmation of a base, with DOGE consolidating near familiar levels from previous weeks. A continued hold above $0.160 could set the stage for a stronger move if broader sentiment improves. Technical Analysis • DOGE dropped 5.36% from $0.170 to $0.161 between July 4 05:00 and July 5 04:00, closing at $0.163. • A key bounce occurred at $0.162 with trading volume reaching 452M during the 16:00–17:00 hour—more than 2x the 24-hour average. • Price action tightened into a narrow band between $0.162 and $0.164, forming a potential short-term base. • A V-shaped recovery played out from 04:00 to 04:59 on July 5, with price climbing from $0.163 to $0.164. • Volume surged to 7.3M DOGE at 04:29, marking the session’s strongest recovery attempt. • Horizontal support at $0.163 has been reestablished, aligning with the prior week’s consolidation zone.