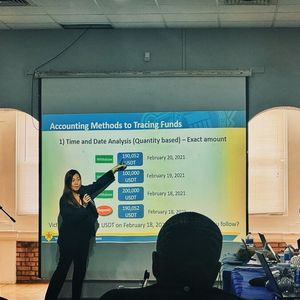

Crypto enthusiast X Finance Bull recently drew attention to Ripple’s positioning as a digital neo-bank, noting the company’s ongoing expansion and infrastructure development. The post highlights that Ripple is now operating with many of the features of a bank—specifically a neo-bank—without holding a traditional banking license. The statement underscores Ripple’s global reach, now extending to over 55 countries, with real-time payment infrastructure and stablecoin functionality already active. According to X Finance Bull, the agility demonstrated by Ripple stands in contrast to the slower adaptability of traditional financial institutions. The tweet ends with a pointed rhetorical question directed at XRP holders: “Is your $XRP bag ready for what’s coming?” An attached infographic further supports this claim, showing Ripple listed on The Financial Brand’s Neobank Tracker as a recognized digital neo-bank. The listing is based on the financial services Ripple provides, such as digital payments, liquidity provision, and stablecoin infrastructure, rather than any banking charter. As explained in the graphic, this designation is tied to service capabilities rather than formal licensing. Ripple is moving like a bank without a banking license. Neo-bank status. 55+ countries. Real-time rails and stablecoin flow ready. The old guard can’t move this fast. Is your $XRP bag ready for what’s coming? pic.twitter.com/S9aDPZmvJA — X Finance Bull (@Xfinancebull) July 3, 2025 Ripple’s Financial Services Model The digital banking services offered by Ripple are centered around its On-Demand Liquidity (ODL) product and the RippleNet network, which facilitate efficient cross-border transactions. Ripple’s infrastructure also supports RLUSD, its recently launched U.S. dollar-backed stablecoin designed for on-chain settlement. These tools enable financial institutions to manage global payments with improved speed and reduced friction. The scope of Ripple’s presence—spanning over 55 countries—emphasizes its ambition to serve as a borderless settlement layer. In a follow-up exchange, an X user named SJ commented on the same post, stating , “The fact Ripple is already a NEO Bank. Just laugh now XRP family. Good times are here already. Ripple was already way ahead of everyone else.” In response, X Finance Bull reiterated the sentiment by affirming , “Facts. Ripple didn’t wait for permission, it just built what the system couldn’t. $XRP fam always saw it coming.” The dialogue reflects a growing confidence among Ripple’s ecosystem supporters regarding its operational capabilities and strategic direction. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Regulatory Positioning and International Reach The attached material also details Ripple’s regulatory standing, noting that it holds money transmitter licenses in several U.S. states. Additionally, it is actively building regulatory credentials across Europe and the Asia-Pacific region. There is speculation that Ripple may eventually seek full national bank status, though no formal announcement to that effect has been made. These developments align with the company’s broader ambition to provide compliant, scalable solutions that mirror or exceed traditional banking functions without assuming the legal responsibilities of a chartered bank. Innovation, Inclusion, and Scalability The infographic outlines several key areas in which Ripple is impacting the financial landscape. Ripple is described as using blockchain technology to deliver secure, real-time services that differ from legacy systems. It is also credited with expanding financial inclusion by making cross-border payments more accessible to underserved markets. The platform’s scalability is highlighted as another advantage, with its infrastructure supporting extensive operations while maintaining efficiency. X Finance Bull’s post and the accompanying graphic portray Ripple as an entity that has grown beyond its role as a blockchain payments company into a full-featured digital financial services provider. The combination of regulatory credentials, global reach, and service offerings that include real-time settlements and stablecoin flows positions Ripple in a category with established neo-banks. By offering services traditionally associated with banks, without seeking a charter, Ripple’s model may represent a blueprint for future blockchain-based financial platforms. As conversations around XRP’s utility and Ripple’s evolution continue, the focus is likely to remain on how effectively the firm can bridge legacy systems with blockchain infrastructure. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on X , Facebook , Telegram , and Google News The post Ripple Is Moving Like a Bank: Expert Says Make Your XRP Bag Ready for What’s Coming appeared first on Times Tabloid .